Intermediation of the HSBC Gold Token

The HSBC Gold Token is a financial instrument offering exposure to gold. This article analyses its intermediation structure.

HSBC, also known as the Hong Kong and Shanghai Banking Corporation Limited by intimates, has recently announced its retail offering of tokenized gold. The new tokens, denominated "HSBC Gold Tokens" are financial instruments that provide exposure to gold.

Upon careful examination of the documentation, we can unpack the multiple facets of the asset. HSBC is introducing a novel financial product with several levels of intermediation: legally, technically, commercially and physically.

Legal Indirect Tokenization

At a high level, purchasers of HSBC Gold Token acquire a new financial instrument. Legally, it is categorized as a "collective investment scheme,” more specifically, a “paper gold scheme” registered with the Hong Kong Securities and Futures Commission (SFC). The SFC has been particularly active in the domain of tokenized assets.

The HSBC Gold Token fits into what we defined as indirect tokenization. Indirect tokenization consists in creating a financial instrument that provides indirect exposure to a tangible or financial asset. In this case, the financial instrument is the “HSBC Gold Token” and the underlying is gold. In terms of jurisdiction, while the instrument is registered in Hong Kong, it is explicitely governed by England and Wales laws.

From a financial standpoint, this instrument can be interpreted as a derivative of gold prices. The term "Fractional Ownership" used in the documents refers more precisely to the ownership of a synthetic financial product. A slight twist to the common usage of fractional ownership in crypto products.

Possession of tokens and ownership

There exists a second layer of indirection with the HSBC Gold Token. As outlined in the "Principal Brochure", the digital tokens do not represent any rights or value directly. As a result, holding a token does not equate to direct ownership of the underlying financial instrument. Thus, the term "HSBC Gold Token" refers only to the financial instrument, the ownership of which is only evidenced by the digital token.

The token is recorded on a permissioned blockchain, where HSBC and its affiliates act as the "Platform Operator." The documentation does not provide additional information on the underlying architecture. Prior publications indicate that it could rely on its internal proprietary blockchain “HSBC Orion”.

However, these tokens cannot be directly exchanged by individuals, nor can any form of composability be developed atop this system. Furthermore, it appears that the token can only be managed through HSBC's online interfaces and applications.

Commercial intermediation of trades

Trading of the HSBC Gold Token is exclusively through the bank, as stipulated in the terms and conditions:

Investors can only trade the Gold represented by the HSBC Gold Token via the Bank, subject to the below:

(i) the price of the Gold represented by HSBC Gold Tokens is determined by the Bank according to the pricing mechanism of the Product;

(ii) any trading outside the Gold Trading Hours will be subject to a higher Bank Margin of 5% at maximum; and

(iii) suspension of dealing may be imposed by the Bank

Gold Trading hours are determined by the overlapping market hours of Hong Kong and London, giving a large window. However, buyers are fully reliant on the bank for fee structures and price calculations. Moreover, while HSBC Gold Tokens are priced in USD, transactions are conducted in HKD, with the conversion handled by the bank "acting in good faith" based on market rates.

Users are thus exposed to various commercial and operational risks. Additionally, as outlined in the documentation, the Financial Institutions Resolution Ordinance (FIRO) in Hong Kong may apply, increasing counterparty risk in the event of the Hong Kong entity's failure.

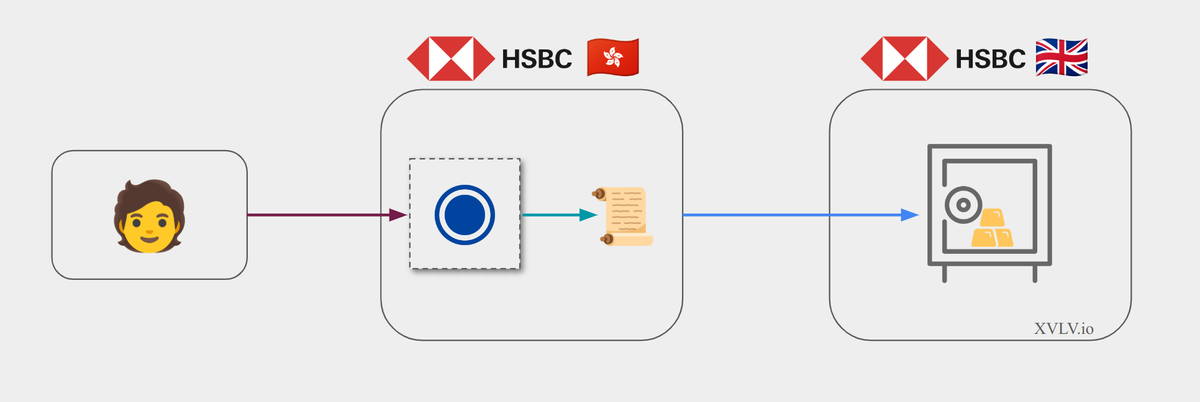

Physical Gold Proxy

The underlying gold is traded in the Loco London Precious Metals Market, a wholesale over-the-counter marketplace for gold and other precious metals. Organized by the London Bullion Market Association (LBMA) and overseen by the Bank of England, this market facilitates trades and settlements of precious metals with a T+2 settlement cycle.

The physical gold is stored in a vault located in England and Wales. Importantly, users will not have the option to take physical possession or delivery of the gold at any point, including in the event of the bank's insolvency. This limitation is partly due to the fact that each token represents a small fraction of gold ( 0.001 troy ounce) while the Loco London market typically deals in much larger physical quantities, with standard gold bars weighing around 400 troy ounces (approximately 12.5 kg).

In the event of bankruptcy, certain mitigation measures are in place. A "reputable" agent will be appointed in the UK to liquidate the allocated gold and distribute the proceeds to investors.

Conclusion

Users who possess an HSBC Gold Token face multiple levels of intermediation. First, the token serves merely as evidence, recorded on HSBC's private ledger. Second, the HSBC Gold Token itself is a financial instrument registered in Hong Kong and held by the local entity. Third, all trading operations of this instrument are mediated by HSBC Hong Kong. Lastly, the financial asset is indirectly backed by physical gold stored in a vault in London.

The HSBC gold token is undoubtedly a pioneering product working around complex market structures and regulations. However, its multi-layered structure brings legal, financial, and technical risks and constraints, potentially limiting the benefits and appeal of such tokenized assets.

References

- 0.001 troy ounce = 31 mg for those who abandoned medieval measures

- HSBC Gold Token - Offering Documents (27 March 2024)

- LBMA - An Introduction to the Global Precious Metals OTC Market (2017)

- Beyond asset tokenisation - The evolving role of asset servicing - Northern Trust (2024)