The Tale of Two Tokenizations

At the finance frontier, the land of tokenization displays lush, green fields. Two movements, approaching from opposite directions, seem on the verge of colliding. One is firmly grounded, bearing the weight and strength of centuries of finance and regulation experience. The other almost soars, stemming from volatile internet cultures and their technologisms.

Institutional Innovations in Tokenization

Regulated financial institutions are exploring tokenization to enhance the efficiency of post-trade settlements and to increase the liquidity of atypical assets. However, this journey carries its fair share of challenges, ranging from governance issues to regulatory uncertainties.

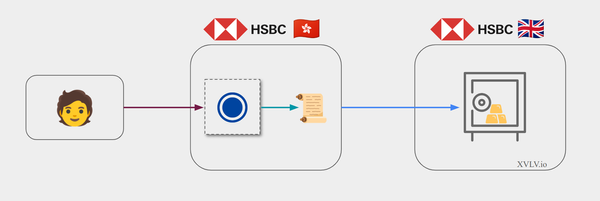

From Private Blockchains To “Permissioned Public”

While institutional experiments remain focused on private blockchains, recent endeavors aim for greater interconnectivity. The influence of public blockchains is increasing, affecting everything from technology to business. Software and languages have become directly compatible. The 'Blockchain, not Crypto' motto is losing steam. The most daring players are even bridging the gap between DeFi infrastructures and traditional financial systems.”

This change of tone is also reflected in banks’ and central banks’ experimentations. There are already some forms of tokenized money circulating on private networks and in public infrastructures, but their access is limited. Recent efforts, from Central Bank Digital Currenices (CBDC) to tokenized deposits aim to open the infrastructures or even to issue these forms of money on more public networks.

Regulatory Landscapes Shaping the Future

The primary weight dragging its advancement is regulatory. Finance needs regulatory clarity and the removal of roadblocks, such as the ability to convert an asset into a digital form, let alone a “DLT” form. Similarly, it needs clarity on how to operate transfers in a secure and compliant way, and on defining ownership and counterparty risks in these new environments.

The EU's "Pilot Regime" is an example of a step in the right direction that builds upon prior national legislation. It allows the issuance of tokenized financial instruments with exemptions from current regulatory frameworks. However, adapting regulations to this rapidly evolving domain presents challenges, as evidenced by the inconsistent terminology and definitions as well as the overlap between existing and new regulations.

The Rise of “Real World Assets”

While crypto started claiming to go for the jugular of traditional finance, it has found some redeeming qualities in traditional assets and partnerships. Fiat currencies have desirable properties in a world of volatility, and bonds become interesting in an environment of high interest rates.

The Stable Growth of Stablecoins

Stablecoins have been pivotal in the development of crypto markets, offering an ideal solution for arbitrage and a limited means of payment. Those backed directly by financial reserves, such as USDC and Tether, provide a backstop of relative credibility. More decentralized projects like DAI or Angle offer tighter integration with the DeFi ecosystem.

However, they have not been without controversies, including the failure of some 'algorithmic stablecoins', the perceived threat posed by large stablecoins, and doubts about the quality of reserves. Despite these challenges, they continue to grow and contribute to a richer ecosystem. As of January 2024, stablecoins represent a staggering $130 billion market, predominantly USD-denominated.

From Security Tokens to Tokenized Bond

The concept of "Security Tokens" has gone through iterations. The first wave, playing on the ICO craze blurred the lines between financial instruments and crypto assets. New projects take a more straightforward approach. These projects are highly integrated, managing everything from asset issuance to trading within the constraints of regulatory requirements.

A rapidly growing segment in this domain is the tokenization of bonds, particularly appealing in times of high interest rates. Leading this charge are tokenized treasury bonds, valued at $800 million, closely followed by tokenized corporate debt at $500 million.

Building upon each other

Despite early skirmishes, these two tokenization movements are ultimately being mutually shaped by each other. Financial institutions are adopting some of the concepts of DeFi, while the crypto ecosystem is expanding to include more regulated approaches. This convergence is not only bridging technological gaps but also encouraging dynamic interplays. Meanwhile, regulatory frameworks are evolving alongside market practices, at times lagging or promoting new models. However, these movements are only the initial steps for the upcoming development of programmable finance.