Money is Trust

However, trust cannot simply be declared.

The essence of money is trust. It occupies a unique role as the ultimate form of liquidity. With no intrinsic value, money represents trust in the future ability to use it to settle monetary obligations. However, this trust cannot simply be declared. Each individual must trust the money, its institutions, and its technical design.

Recent efforts on future forms of money have resulted in a shift where central bankers and international institutions step away from the traditional pedestals of macroeconomics and sovereignty to recognize that this trust must be reflected in every dimension of the technology.

⚙️ Trust in Robustness

The technologies of public blockchains have infiltrated the minds of most actors. Here, is a rebranded vision of Web3. There, "Bitcoin already offers a perfectly functioning infrastructure for international payments. The unit of account nevertheless remains an issue for sovereignty and monetary policies."

However, the robustness of cryptocurrency technologies in a regulated environment is complex. The addition of permissions, compliance rules, and “circuit breakers” challenges the foundational assumptions of the technology.

Similarly, open source is mostly beneficial for facilitating cooperative research and public scrutiny, but it requires careful management to maintain security and integrity.

Moreover, whether using Distributed Ledger Technologies (DLT) or more conventional approaches, it is necessary to prepare for new challenges such as AI and quantum computing.

🔒️Trust in Privacy

Not all activities and payments are equal, and some require privacy. While shopping online for clothing can exist in a transparent world, some activities and cultures require strong privacy guarantees.

There is a risk that private actions could be controversially exposed, or data could be used to identify political opponents. A recent study on the adoption of e-CNY in China have shown that the populations are aware of these situations. The “Privacy Paradox” might not exist in sensitive matters.

While retail CBDCs are being designed as a public good, and most of them facing upcoming adoption challenges, these considerations are increasing in importance. Offline payments or the use of Zero-Knowledge proofs are investigated as improving the inherent tradeoffs of privacy and compliance.

🎛️ Trust in Control

The dangers of some capabilities are more evident as the aim is to build a system for all, especially for retail CBDCs. For example, while programmability could be used for efficiency or to implement targeted fiscal measures, it could have downsides.

As Hannah Arendt explains in Eichmann in Jerusalem, the essence of totalitarian government is to transform individuals into cogs within a machine. With technology supporting this mechanization of social constructs, dangerous situations could arise. Even among central bankers, the risk of techno-authoritarianism, or simply suboptimal measures, appears more evident.

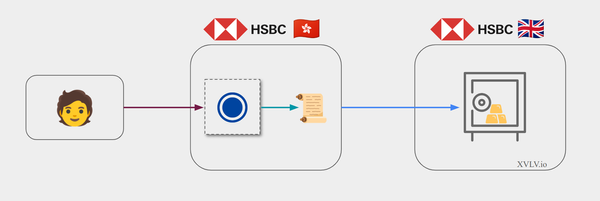

As a result, the benefits of programmability are more unambiguous in wholesale infrastructures. There, automation could facilitate large payments and settlements and interoperability between systems. Programmability remains a hot topic.

Conclusion

The more complex new systems are, both institutionally and technically, the more necessary it becomes to provide elements that ensure public trust. Digital technologies could contribute to this trust, but they can also destroy it due to hacks, errors, or poor design.